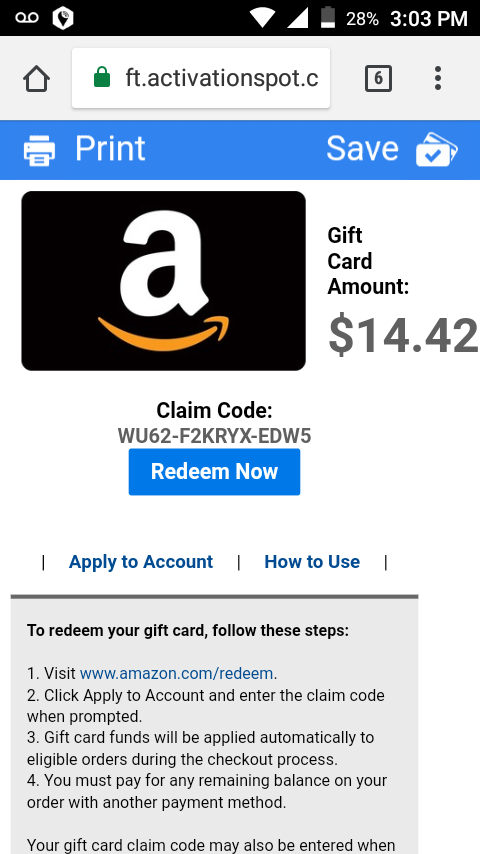

$2 BACK FROM COUPONCABIN SAVINGS SIDEKICK SOFTWARE

These Terms and our Privacy Policy, incorporated herein by reference, govern your use of our online services, any application or software created or distributed by us, any content or information therein, the website, any subdomains of, and any other website pages or applications on which services or content are provided by us or that display or provide an authorized link to these Terms (collectively, including any such websites or applications, the "Services"). Jill may claim a 50% credit of $1,000 for her $2,000 IRA contribution on her 2021 tax return.This is the Terms and Conditions Agreement ("Terms" or "Agreement") of CouponCabin LLC ("CouponCabin" or "us" or "we"). After deducting her IRA contribution, the adjusted gross income shown on her joint return is $39,000. Jill contributed $2,000 to her IRA for 2021. Jill’s spouse was unemployed in 2021 and didn’t have any earnings. Use the chart below to calculate your credit.Įxample: Jill, who works at a retail store, is married and earned $41,000 in 2021. The maximum contribution amount that may qualify for the credit is $2,000 ($4,000 if married filing jointly), making the maximum credit $1,000 ($2,000 if married filing jointly). Also, your eligible contributions may be reduced by any recent distributions you received from a retirement plan or IRA, or from an ABLE account. Rollover contributions do not qualify for the credit. contributions made to an ABLE account for which you are the designated beneficiary (beginning in 2018).contributions to a 501(c)(18)(D) plan, or.voluntary after-tax employee contributions made to a qualified retirement plan (including the federal Thrift Savings Plan) or 403(b) plan,.elective salary deferral contributions to a 401(k), 403(b), governmental 457(b), SARSEP, or SIMPLE plan,.contributions you make to a traditional or Roth IRA,.

$2 BACK FROM COUPONCABIN SAVINGS SIDEKICK SERIES

Amount of the creditĭepending on your adjusted gross income reported on your Form 1040 series return, the amount of the credit is 50%, 20% or 10% of: See Form 8880, Credit for Qualified Retirement Savings Contributions, for more information. It does not include on-the-job training courses, correspondence schools, or schools offering courses only through the Internet. Took a full-time, on-farm training course given by a school or a state, county, or local government agency.Ī school includes technical, trade, and mechanical schools.

You're eligible for the credit if you're: You may be able to take a tax credit for making eligible contributions to your IRA or employer-sponsored retirement plan. Also, you may be eligible for a credit for contributions to your Achieving a Better Life Experience (ABLE) account, if you’re the designated beneficiary. Check out the 2022 cost-of-living adjustments for retirement plans and IRAs.

0 kommentar(er)

0 kommentar(er)